Is Credit score Suisse Inventory a Purchase, Promote, or Maintain? Additional, the transfer will cut back the general legal responsibility and optimize curiosity bills for the monetary companies big. Then again, to revive shareholders’ confidence, Credit score Suisse introduced that it could buyback debt ($2 billion in U.S.-Greenback-denominated senior debt securities and €1 billion in euro or pound sterling-denominated senior debt securities) to capitalize on enticing market costs. Sixth Road, Pimco, and a bunch of buyers, together with Centerbridge Companions, are among the many bidders for Credit score Suisse’s securitized merchandise enterprise, Bloomberg reported. Nevertheless, CS inventory remains to be down roughly 49% year-to-date. Notably, CS inventory gained about 24% final week. Furthermore, the Swiss financial institution’s shock transfer to purchase again $3 billion value of debt additional supported the restoration. The rebound in CS inventory adopted the information that buyers are displaying curiosity in its securitized merchandise enterprise, which is up on the market. The opinions expressed in this article are those of the writer, subject to the Publishing Guidelines.Shares of the main monetary companies firm Credit score Suisse ( NYSE:CS)( GB:0QP5), which got here underneath strain over its liquidity and monetary well being considerations, recovered a few of its misplaced floor final week. On the date of publication, Mark Hake did not hold (either directly or indirectly) any positions in the securities mentioned in this article. That is a potential gain of 64.8% in Spotify stock.Īs a result, assuming that its Q1 results show its growth is on track, SPOT stock could move significantly higher. In addition, TipRanks reports that its survey of 23 analysts that have written on the stock in the last 3 months has an average target price of $232.86.

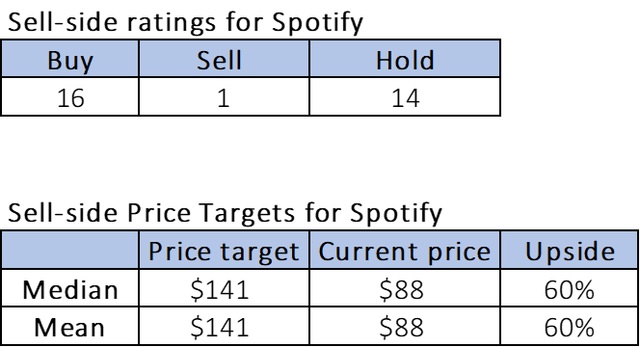

That represents a 64% upside in the stock which closed at $141.28 on April 8. Refinitiv’s survey of 26 analysts shows that SPOT stock will reach a target price of $231.17. This included a 16% growth in paid subscribers and a 19% growth in ad-related MAUs. Last year, Spotify had an 18% growth in MAUs to 406 million. This likely coincides with its underlying growth in monthly active users (MAUs). For example, analysts surveyed by Refinitiv (seen on Yahoo Finance) forecast 11.4% higher growth for Q1.Īs it stands, analysts now forecast an 18.7% growth in revenue this year from $10.68 billion to $12.68 billion. Spotify recently pulled its employees out of Russia, so that could hurt its Q1 revenue, but its underlying growth is strong. Apparently, people are more willing to listen to ads while listening to podcasts than listening to music. Podcast revenue has also led to higher ad revenue, a source of growth for Spotify. Paul Vogel, Spotify’s CEO, recently told a Morgan Stanley conference that increasing podcast spots are driving its growth in ad revenue. This is higher than its normal 90%/10% premium to ad revenue split. In Q4 it rose 40% to $394 million, or 14.6% of the total.

Most of the company’s revenue is from premium subscriptions, but its ad revenue is now growing quickly. Last quarter, the company reported revenue growth of 24% year-over-year (YoY) to almost $2.69 billion.

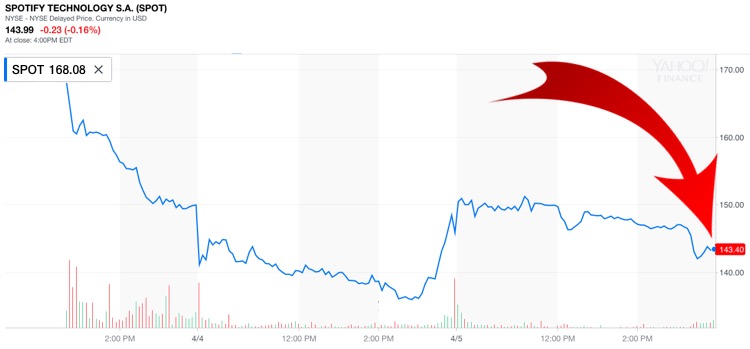

That could help push SPOT stock higher, as it has had a rough time so far this year. Spotify (NYSE: SPOT) plans on releasing its first-quarter results on Wednesday, April 27.

0 kommentar(er)

0 kommentar(er)